There are many reasons why Minreet Kaur has never moved out of her parents’ house, but none of them are to do with money.

At 43 years old, Minreet’s mum and dad are her best friends. She’s lived in the same West London two-bed terrace with them, which they’ve owned since the 1970s, for more than four decades.

Every morning, Minreet and her mum, Pritpal, 73, make a cup of Indian tea, before going for a walk or a swim. They enjoy baking cakes, and Minreet’s introduced her mum to Netflix. The family are all avid runners; Pritpal completed the London Marathon in 2023, while Minreet crossed the finish line with her dad, Rajinder, 76, this year.

Minreet, a journalist, has slept in the same bedroom since childhood. The white cupboards, pink walls and white door have been there for 40 years.

‘All random colours chosen by my dad, who’s never wanted to change anything,’ Minreet tells Metro. She hasn’t added too much in the way of personal effects as she ‘doesn’t feel it’s her room.’

But she says that living with her parents is infinitely more comfortable than any home she’d be able to make for herself. She worries she’d feel isolated living alone.

‘They let me do what I want, and they leave decisions to me as they know I’ve always taken care of them,’ Minreet shares.

‘When I changed career, they told me not to worry if I have to do some unpaid work as they can support me — that’s a really nice thing for them to do too.’

Minreet contributes to the household bills and pays for the weekly food shop, petrol, and insurance policies — and she never asks her parents to chip in.

‘They have worked all their lives. It’s my duty to look after them,’ she says.

She spends around £500 per year on car insurance, £100 per month on energy bills, £37 per month on water and £50 per week on food. She’s also now a carer for Pritpal who lives with myeloma, a form of bone marrow cancer.

Can Minreet ever see herself moving out? Yes — but only if her parents came with her.

‘I want to buy a house as a first-time buyer, but I would still move my parents in with me,’ she says.

Of course, there are challenges to living with your parents in your 40s. Organising plans can be difficult, as her parents like to know where she’s going and when she’ll be home. ‘I feel guilty if I’m out and want to come home whenever I like. They will stay up and wait — it’s an Indian cultural thing and they worry a lot,’ Minreet adds.

Minreet, who is single, says dating is also tricky. She says men are ‘put off’ by her living arrangements — and there are other challenges too. Rajinder sleeps downstairs, and Minreet says she’d never want to wake him up when coming home late, whether with friends or with a date.

For Pritpal and Rajinder though, having their daughter at home is a blessing.

‘It’s brought us closer together,’ Pritpal tells Metro. ‘She brings a lot of warmth and noise to the house in a good way. She makes us laugh, and we are so blessed to have her.’

But, Pritpal does encourage her daughter to move out: ‘We do worry about her, as we would hate to see her on her own when we aren’t here anymore.’

It’s little surprise that adult children are actively choosing to stay at home. For many, money – and the general state of the housing market – is a huge obstacle.

It’s estimated that Gen Z are facing average monthly mortgage payments of £1,739 – double the Millennial average of £863, and almost thrice that of their Boomer grandparents who have paid around £775. And, in 2023, just 20.1% of 25 to 34-year-olds and 28.4% of 35 to 44-year-olds were homeowners.

And, in other cultures, multi-generational households are nothing unusual. In Italy, grandparents play a significant role in family life, and there’s even a Grandparents’ Day: Festa dei Nonni. In India, according to a national survey, only 40% of elderly couples live without their children (or only with their unmarried children).

And in 2025, fresh research from the Institute for Fiscal Studies (IFS) finds that the number of 25 to 34-year-olds living with their parents has now increased by more than a third since 2006.

Then, 13% of this cohort were living at home, while by 2024, this figure had increased to 18%, equating to around 450,000 more young adults.

‘Stronger bond’

Back in the UK, Conor Lindsay, 27, is at the age you’d expect he’d fly the nest, but he’s enjoying fostering a closer relationship with his parents.

Conor hasn’t always lived at home in adulthood. He spent time in Australia, and has also lived with a friend. But after returning to the UK, with a small amount of savings and no job, he temporarily moved back in with his mum, Carmel, 56, and dad, Gary, 57 — a set-up which has now become long-term.

Conor, who lives in central Scotland, tells Metro: ‘I’ve always got on well with my parents as they’re quite laidback, but the older I’ve got, I think it’s turned into more of a friendship, rather than just being parented by them. It’s made our bond 10 times stronger.’

Conor pays £250 per month for both rent and bills. He does a separate food shops, but they share household items, like butter and milk.

‘We all do our own housework but I clash with Mum over cleaning,’ Conor says, dubbing Carmel a ‘clean freak’ before adding that, deep down, ‘I know she’s right.’

The family also have shared hobbies. Both Gary and Carmel, who have an older daughter, Jess, 30, play dominos together most nights. ‘I’ll join in and play which is nice,’ Conor adds. Conor and his dad also enjoy a weekend ‘tradition’ of watching Soccer Saturday.

The electrical engineer adds that he likes having a ‘support system’ around him. ‘As a single man, living alone can be very quiet. I don’t struggle with loneliness, but living alone is a lot less homely. I don’t think that feeling can be replicated unless you live with your family.’

But there are a few drawbacks to his situation – namely that, since his parents work different shifts, there is always someone at home.

‘I can’t really bring a date to the house unless I’m sure it’s going to be serious,’ Conor adds. ‘Weirdly when I was younger it didn’t bother me, but now I cringe at the idea!’

By comparison, all of Conor’s friends are on the property ladder, but he acknowledges that he simply prioritised travel over buying a home.

‘I’d like to buy my own place one day, but it’s going to take a while to save,’ Conor shares.

Meanwhile, Carmel and Gary love having their son at home. ‘We all get on well together,’ says Carmel. ‘We have plenty of room and we all eat at different times. We set him an amount and it’s always paid. Conor’s respectful of us, so it all works.’

While Conor pays his parents, not all families opt for this set up.

‘The best part of every day’

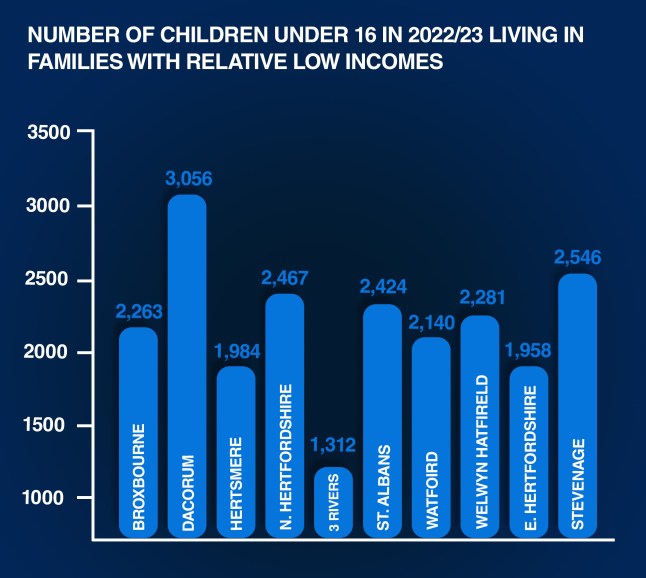

Shakila Karim, 26, lives at home with her mum, Sultana, 49, and dad, Karim, 51, in Hertfordshire. As an aspiring musician with no fixed income, she doesn’t pay her parents any rent, bills, or money towards the family food shop.

‘If I want specific snacks or alcohol I buy that myself, as my parents don’t drink,’ says Shakila, who is the reason for her family’s Ferrero Rocher sweet tooth — a treat she likes to buy the family.

When it comes to other household expenses, she pays for her own phone bill and car.

Shakila says their living arrangement works because they’re all so close. ‘I help Mum with her makeup, especially applying false eyelashes!’ says Shakila. ‘And I’m always borrowing her accessories, especially if I need more traditional clothing for a wedding. One time I needed to borrow her clothes for a Bollywood night in Hackney.’

And, her parents are always keen to hear her new material. ‘My dad always wants to be the first to hear my songs,’ she says. ‘He’s not very good at giving constructive criticism — he’s always a fan.’

Like Conor, Shakila’s initial motives for living at home were financial — she can save money while building her career. But she adds that now, ‘even if she had the cash to move out’ she’s not sure she would.

‘My parents are from a South Asian culture so they don’t really push their kids to move out as soon as possible. For me, it’s a cultural thing as well.’

Sometimes though, living at home is challenging for Shakila, who feels that her parents might use her as a safety net. ‘They rely on me a bit too much to be available when it comes to things like giving lifts,’ she says, remembering a rather early drive to Stansted Airport.

And, her ex-boyfriend used to ‘mock’ her for living at home. ‘I’m happy to always introduce my family to new partners, but it is a bit annoying how early it has to be, because I don’t have much of a choice to avoid it.’

But for Karim, continuing to live with his daughter has been nothing but positive.

‘My favourite thing is seeing her every day and having a chat whenever possible. I enjoy learning so much from Shakila,’ he says. ‘It’s beautiful to have someone who is so knowledgeable and compassionate.’

And, despite Shakila’s insistence that she enjoys living at home, Karim thinks her mind will change.

‘We don’t know how long she will be living with us, but we’re hopeful she will get a lucky break and have a career in music. I think she will want to live in her own property then.’

‘This can be a challenging dynamic’

‘When adult children live with their parents at the family home it can help to keep wider family relationships together. It can provide adult children with an opportunity to spend more time with extended family,’ Fiona Yassin, family psychotherapist, and founder and clinical director of The Wave Clinic explains.

But, the arrangement can be a tricky one. ‘In adulthood, the child is no longer looking for the parent to be their guide or fixer. They now have developed viewpoints and opinions, and they won’t necessarily match the parent’s.

‘As a parent, you’re no longer providing the answers for a child. It’s now about two people expressing and sharing their own opinions, views and thoughts. This can be a really challenging dynamic. The key is to have respect and honesty.’

And, it can be all too easy to slip into old habits and behaviours.

‘The adult child will often slip into the role they had when they were younger – whether that’s through the language they use, mannerisms, or the way they expect things to be done,’ Fiona shares.

‘It’s likely the parent won’t want to take on a role of servitude, so the ‘old’ ways will need to shift. This should be the first boundary set – deciding the ‘new’ ways of living together.’

This article was originally published on November 19, 2024.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.